Maximize Your Savings With Cooperative Credit Union

Discovering how credit rating unions can help you optimize your financial savings is a tactical step in the direction of safeguarding your financial future. By recognizing the advantages credit score unions offer, you can make enlightened decisions to optimize your savings possibility.

Advantages of Cooperative Credit Union for Financial Savings

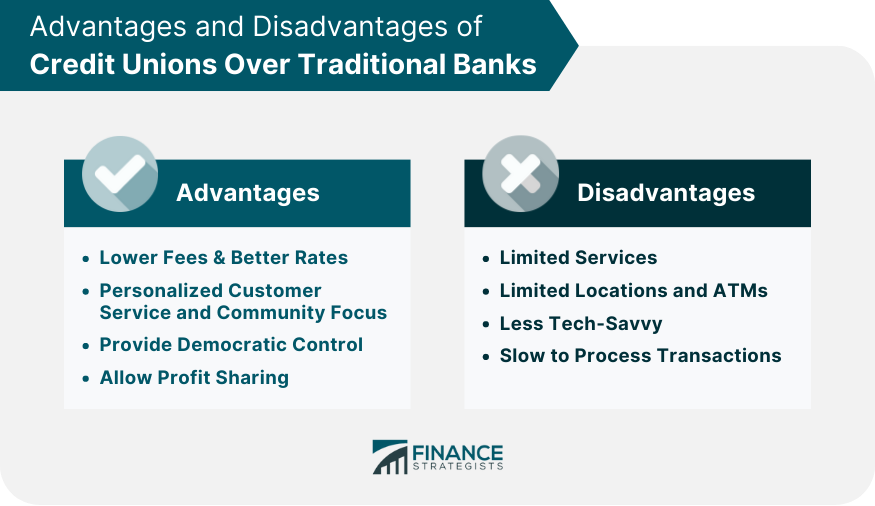

Credit score unions supply a variety of advantages for people wanting to optimize their financial savings potential. One trick advantage is the personalized solution that lending institution give. Unlike conventional financial institutions, credit history unions are member-owned and operated, enabling an extra tailored technique to client service. Participants often have straight accessibility to decision-makers and can get tailored economic guidance to aid them accomplish their savings goals.

An additional benefit of cooperative credit union is their affordable rate of interest on interest-bearing accounts (Hybrid Line of Credit). Lending institution are understood for offering higher passion prices compared to lots of financial institutions, permitting participants to earn more on their savings over time. Additionally, cooperative credit union usually have lower charges and minimal equilibrium needs, making it simpler for people to start saving and grow their funds without being burdened by excessive charges

Additionally, lending institution are community-focused banks, commonly investing back into the communities they offer. This community-oriented strategy can be interesting individuals wanting to support regional initiatives and organizations while additionally growing their savings in a relied on and dependable institution.

Greater Yields on Financial Savings Accounts

To make the most of returns on your financial savings, looking for monetary establishments that provide greater yields on cost savings accounts is a sensible choice. Credit unions usually offer a lot more affordable passion rates on cost savings accounts compared to typical financial institutions.

Greater yields on interest-bearing accounts can cause a significant difference in the quantity of interest made over time. Also a somewhat greater rates of interest can result in recognizable growth in your savings equilibrium. This can be specifically beneficial for individuals looking to develop their reserve, conserve for a specific objective, or just boost their monetary protection.

Lower Costs and Fees

Looking for financial institutions with lower fees and fees can better maximize your financial savings approach past just concentrating on higher yields on cost savings accounts. Credit history unions are recognized for providing lower fees contrasted to traditional financial institutions, making them an attractive choice for individuals looking to maximize their savings.

Furthermore, credit report unions often prioritize their members' economic health over maximizing earnings, leading to fewer and more reasonable costs general. Several lending institution also supply fee-free bank account and interest-bearing accounts without regular monthly upkeep fees, helping you save also extra. When comparing different banks, make sure to think about not only the passion rates yet likewise the different costs and fees related to their accounts - Credit Union in Wyoming. Choosing a credit union with reduced fees can substantially affect just how much you can save in the long run.

Personalized Financial Support

For people aiming to improve their monetary decision-making and attain their saving goals, accessing customized monetary advice is vital. Lending institution are recognized for supplying personalized monetary support to their participants, aiding them browse numerous financial circumstances and make notified options. This tailored technique sets cooperative credit union besides typical financial institutions, where one-size-fits-all solutions may not deal with individual requirements efficiently.

Customized economic assistance offered by credit history unions frequently includes budgeting support, debt management strategies, investment guidance, and retirement planning. By recognizing each participant's special monetary circumstances and goals, lending institution economic consultants can provide tailored referrals to assist them maximize their financial savings and attain long-lasting this hyperlink economic stability.

Furthermore, debt unions focus on monetary education and learning, equipping members to make audio financial choices separately. Via workshops, workshops, and one-on-one consultations, lending institution equip their participants with the understanding and skills needed to handle their finances properly. This commitment to individualized monetary guidance enhances the cooperative nature of cooperative credit union, where participants' financial wellness is a leading priority.

Maximizing Financial Savings Opportunities

Discovering different methods for making best use of savings can dramatically influence your monetary health and future security. One efficient means to maximize savings chances is by benefiting from high-yield interest-bearing accounts supplied by lending institution. Unlike typical banks, credit report unions are member-owned banks that commonly use greater rates of more information interest on cost savings accounts, allowing your money to expand at a much faster rate.

An additional technique to consider is automating your cost savings. Setting up automated transfers from your bank account to your interest-bearing account monthly ensures that you consistently add to your financial savings without having to believe concerning it. This powerful yet easy technique can assist you develop your financial savings easily gradually.

Final Thought

To conclude, taking full advantage of financial savings with cooperative credit union offers countless advantages such as higher yields on interest-bearing accounts, reduced fees, and customized monetary assistance. By taking advantage of these chances, people can maximize their long-lasting financial savings prospective and achieve higher financial security. Think about checking out different financial savings choices used by credit score unions, such as high-yield cost savings accounts and certificate of down payment choices, to branch out savings strategies and increase economic development.

To make best use of returns on your financial savings, looking for monetary institutions that provide greater yields on cost savings accounts is a sensible option.Seeking economic establishments with reduced costs and costs can additionally optimize your cost savings technique past just concentrating on greater yields on savings accounts. One reliable way to maximize financial savings possibilities is by taking advantage of high-yield financial savings accounts offered by credit unions.In conclusion, making the most of cost savings with credit scores unions offers countless advantages such as greater yields on financial savings accounts, lower costs, and personalized monetary advice. Think about checking out different cost savings alternatives offered by credit score unions, such as high-yield cost savings accounts and certificate of deposit alternatives, to diversify savings techniques and accelerate economic growth.

Comments on “Discover Top Credit Unions in Wyoming: Your Overview to Financial Services”